- Guterres Urges Leaders to Act as UNGA Week Begins |

- BNP to go door to door for hearts and votes |

- Chittagong port tariffs increased up to 50 per cent |

- Rising Heat Cost Bangladesh $1.8 Billion in 2024 |

- Stocks extend gains; turnover drops in Dhaka, rises in Ctg |

Bangladesh's Public Foreign Debt Rises by $4.2B in Q4 FY24

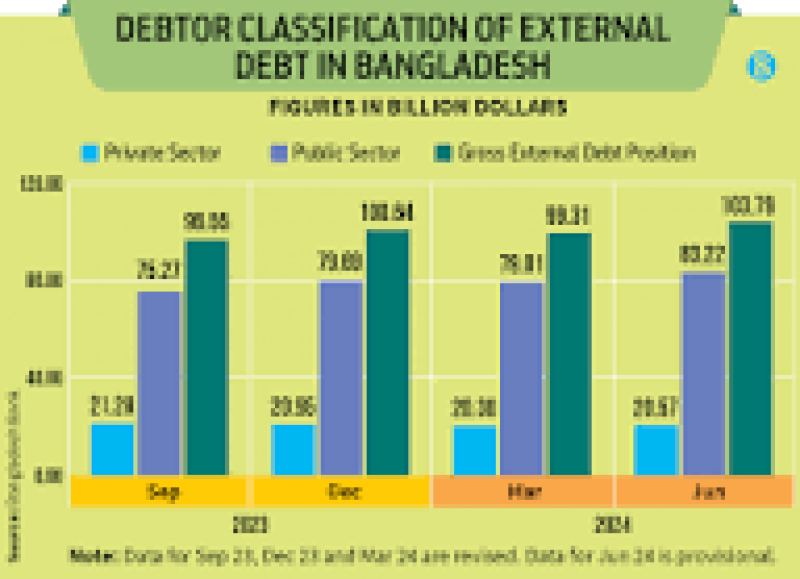

In the final quarter of fiscal year 2023-24, Bangladesh's public foreign debt surged by $4.2 billion, largely due to disbursements of long-term loans from the IMF, World Bank, and various bilateral and multilateral partners.

According to a report from the central bank, by the end of June, the outstanding public foreign debt reached $83.22 billion, with approximately $80 billion classified as long-term debt. Private foreign debt stood at $20.57 billion, bringing the total gross foreign debt to $103.79 billion.

Notably, around 80% of this external debt was incurred by the government, while the remaining 20% was sourced by the private sector. This has resulted in a per capita debt of $605, or Tk72,480, up from just $257 at the end of FY16.

A central bank official explained that although a significant portion of these loans is long-term with lower interest rates, the rising exchange rate poses challenges to repayment. He suggested that if the previous Awami League government had effectively utilized these loans, the current dollar crisis might have been less severe.

As of December 2023, the country's external debt had already surpassed the $100 billion mark, reaching $100.64 billion for the first time.

Fahmida Khatun, executive director of the Centre for Policy Dialogue (CPD), emphasized that the lack of adequate dollar reserves forces Bangladesh to seek foreign debt from various sources. She pointed out a consistent upward trend in foreign debt over recent years. By the end of FY24, the foreign debt-to-GDP ratio stood at 22.6%, compared to 15.6% in FY16, indicating a significant increase.

Khatun reassured that, while many developed nations also carry foreign debt, Bangladesh's ratio is not excessively high. "What truly matters is how we utilize these loans," she remarked, stressing that effective management could ensure successful repayment.

In FY24, foreign debt servicing climbed nearly 26% to $3.36 billion, driven by a record 44% increase in interest payments, which reached approximately $1.35 billion amid rising borrowing costs. Bangladesh's payments to development partners included $2.67 billion in FY23—$1.73 billion in principal and $935.66 million in interest. This escalated in FY24 to $2 billion and $1.34 billion, respectively.

Khatun highlighted that while payment liabilities are increasing, effective debt management can mitigate potential issues. "The new government must prioritize minimizing waste and corruption in the use of these loans," she urged.

Over the past decade, Bangladesh's external debt has surged by over 350%, rising from $29.3 billion in June 2013 to $104 billion by June 2024.